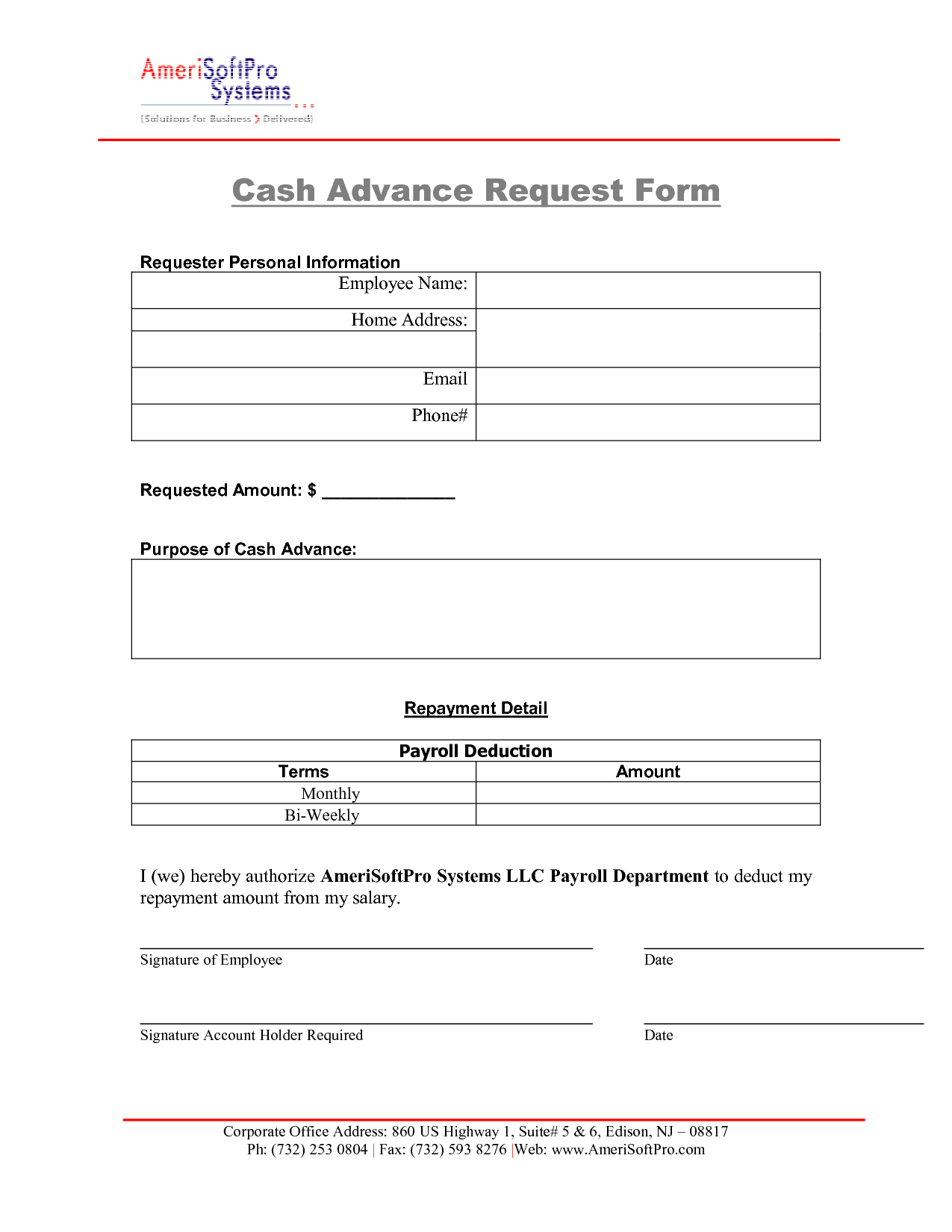

Is a report on regular coverages within this a homeowners rules

- Chief hold: That it exposure handles your home in case there is wreck or depletion due to such things as flame, super, windstorms and you may vandalism.

- Most other formations: So it covers formations at your residence that aren’t connected to the domestic, such as for instance a detached driveway, destroyed or fence

- Individual property: Exposure boasts your personal house like seats, appliances, clothing and you may electronics in case of theft, wreck, or exhaustion on account of shielded danger each other in and out your household

- Liability: This may safety judge costs, medical expenditures and settlements or judgments when someone is harmed into the your property or you eventually cause damage to somebody else’s assets.

- More living expenses: That it exposure could help pay for temporary cost of living if the family becomes uninhabitable on account of a secure losings-as well as resort bills, food or other will set you back incurred if you’re you reside being repaired or reconstructed.

- Scientific expense: So it exposure protects your bank account if the an invitees was harm into the your house, despite who’s at fault.

Even although you individual your residence, homeowners insurance has been demanded to has safeguards and you may assurance in case of assets destroy, thieves, liability claims and other unexpected occurrences. It may help safeguards the cost of repairs or perhaps to rebuild your house, replace private possessions otherwise coverage courtroom costs if someone are damage while on your house.

Even though these are typically equivalent, possibilities insurance policies and home insurance aren’t the same. Possibilities insurance is a component of home insurance you to definitely specifically talks about damage to your home caused by specific dangers otherwise risks, for example fire, super, windstorms, hail otherwise vandalism. It helps manage your house and its particular content material facing these specific risks. Homeowners insurance try a wider rules one typically includes hazard insurance policies together with other coverages. It gives shelter for the hold and yours property, liability exposure if someone was hurt on your property and extra cost of living in case the domestic gets briefly uninhabitable because of a beneficial secure skills.

Most home insurance guidelines defense a wide range of things, even so they never usually safety that which you you have. Which emptiness inside coverage might be as a result of the policy holder provided that every item he has got would be safeguarded. It neglect to allow the insurance broker discover regarding specialization affairs and you will specialty publicity they may need or even be finding. Chat to the insurance broker to determine whether or not you would like additional publicity regarding pursuing the elements:

Listed here is a breakdown of regular coverages within this a home owners plan

- Superb and antiques

- Home office devices and you can household people

- Identity theft

Zero. If you are flood wreck actually covered by very home insurance regulations, we could render a different sort of rules from the National Flooding Insurance Program for additional visibility needs.

Very home insurance principles provides dollar limits toward certain kinds of residential property. Essentially, these constraints take cutlery, guns, jewellery, observe, furs and computers. The limitations always defense losses of person with average skills. Speak to your representative or insurance company regarding the increasing such limits to meet up with individual need.

Replacement-rates visibility in this a home owners insurance is advantageous change your domestic and residential property with product away from like type and you can quality within current rates, if you are actual cash-really worth regulations refund the fresh new depreciated worthy of.

Although not, mortgage lenders typically wanted consumers to get home insurance once the a beneficial reputation of a loan to guard its funding if there is people destroy otherwise loss into property

Fundamentally, insurance ban damage because of seepage, dry-rot or vermin. It is because these issues are generally the consequence of poor repairs in the place of a rapid otherwise accidental enjoy.

Home insurance typically covers the structure or design in america cash loans North Granby your home or any other attached formations, together with your driveway and you may platform.