The favorable Neighbor Next door program especially needs societal servants, and you may a life threatening percentage of the individuals eligible was experts. Va Funds are especially designed to let experts and energetic armed forces teams get to homeownership. When and GNND, Va finance render an irresistible advantage.

Qualified veterans might be able to funds its GNND home with no down-payment, maximizing its savings. And, Virtual assistant Financing appear to boast aggressive interest levels, then reducing the total cost from ownership.

Traditional Funds: A strong Option for Situated Credit

Traditional Money provide a different capital option for GNND members. When you’re Conventional Funds normally have more strict credit score requirements and better downpayment minimums than just FHA and you may Virtual assistant Loans, it often allow for huge mortgage number.

It is of good use when you have a high credit rating and also have stored a whole lot to possess an advance payment. If the GNND household the thing is is charged over the limits out-of FHA otherwise Virtual assistant Funds, a normal Mortgage may connection the gap, enabling you to enjoy the program’s positives.

USDA Fund: An outlying Chance which have Money Constraints

The latest GNND program isn’t simply for urban areas. It can extend to revitalization efforts within the appointed rural organizations as the well. USDA Money are especially designed to help homeownership in outlying elements.

However, they actually do include certain conditions. The house or property you select need to be located in a beneficial USDA-appointed outlying town, and you will probably need see certain income limits so you can meet the requirements. If you find good GNND house for the an excellent USDA-recognized outlying venue and you can meet up with the income eligibility, an effective USDA Loan shall be a good choice. USDA Loans often ability low interest rates and versatile words, leading them to a nice-looking selection for people who be considered.

Locating the Perfect Mortgage Complement

An educated mortgage for the Good neighbor Across the street buy depends in your financial predicament as well as the particular possessions you choose. Situations such as your credit score, deposit discounts, armed forces service background, and also the property’s location have a tendency to the donate to deciding your perfect funding solution.

Talking to an experienced home loan elite group should be thought about. They are able to determine your eligibility for each and every mortgage particular and you can book you into the the choice that maximizes some great benefits of the great Neighbor Next-door system and you will aligns really well together with your monetary specifications.

Understanding the thirty six-Day Abode Requirement

An option facet of the Good neighbor Next-door system is your commitment to living in the brand new bought house as your best residence getting no less than 3 years (three years). Is why this is very important and all you have to see:

- The point : The new home demands is made to make sure GNND participants become real stakeholders regarding neighborhood’s revitalization. They prompts much time-identity funding locally helping would balances.

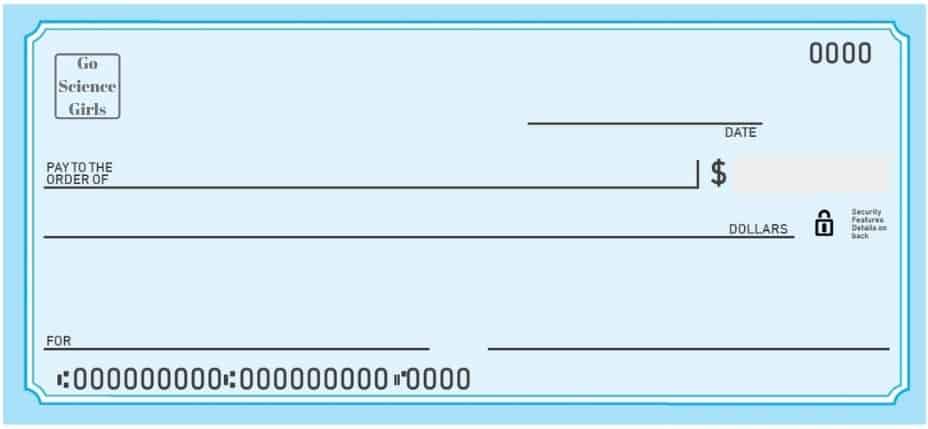

- Another Financial : When you purchase a house compliment of GNND, your indication an additional home loan and you may note. Which second financial signifies the new fifty% discount your received for the household. For many who fulfill the 36-times home specifications, another mortgage was forgiven.

What the results are If i Split the brand new GNND Contract?

If you wish to promote otherwise move out of one’s GNND family up until the 36 months try right up, you are required to pay-off a portion of the disregard your obtained. The exact number utilizes how much time you stayed in the possessions.

Extremely important Factors

- Bundle In the future : Before purchasing an excellent Neighbor Across the street household, think about your future agreements very carefully. Are you presently sure you could agree to staying in our home for around 36 months?

- Existence Transform : We understand you to definitely unforeseen factors can also be happen. If for loans Wiggins example the situation change, contact HUD otherwise the lender to go over the options.