Offer Proof Money

To further be certain that your revenue, be prepared to getting requested intricate bank statements and you may spend stubs. Loan providers need to know your earnings frequency, therefore the amount you make. These monetary records can help bring facts you may have an effective earnings collection and can manage the higher loans stream away from a good jumbo financing. Any other documents which can help guarantee your revenue, such as for example earlier bills or contracts, also are beneficial to bring.

Decrease your Obligations to Income Proportion

Away from credit scores, your debt-to-income proportion (DTI) is perhaps the most important contour loan providers want to see whenever considering jumbo home mortgages. That it profile, that is offered inside fee setting, is the amount of cash your draw in compared to number your debt. Such as for example, if you make $10,000 thirty day period and you may owe $2,500 30 days in financial trouble costs, your debt in order to income ratio was 25%. Loan providers imagine a lower DTI as much safer than simply a good higher that installment loan New Mexico.

When you find yourself coming down your debt is one way to reduce brand new DTI, you’ll be able to improve noted earnings that have levels eg IRAs, investment account and you may 401(k) accounts. While this type of profile are handled in another way because of the character off jumbo loans, they could tell you loan providers available tips to assist service larger home loan repayments.

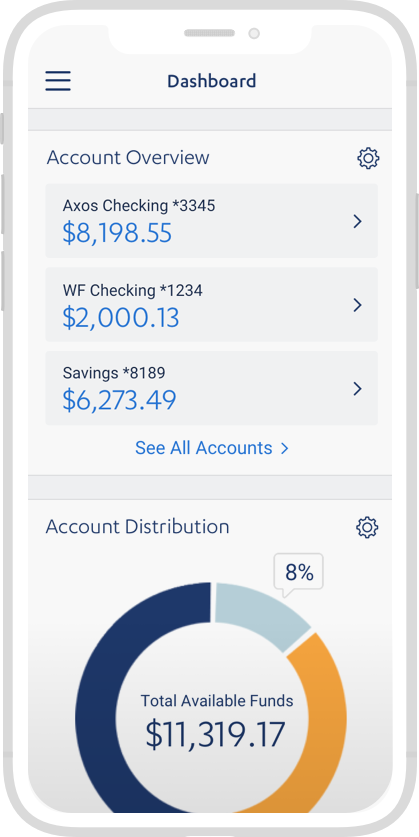

Whenever borrowing from the bank considerable amounts regarding financing, finance companies like to see too much money into your savings levels. That it set aside dollars brings loan providers higher reassurance that you are not just financially in charge, and in addition that one may handle your own mortgage repayments if you sense a drop for the income for any reason. Very loan providers like to see about half dozen months’ worth of financial (or other debt) money in set-aside. However, when speaking about a diminished credit history to possess an excellent jumbo mortgage, loan providers might require a complete year’s value of discounts. Definitely, people set aside bucks should be in addition to a down payment, settlement costs, and other appropriate charge.

Check out Varying Rates Mortgages

Occasionally, adjustable rate mortgages (or Sleeve financing), are the best option for you and the lending company. Adjustable rate mortgage loans can bear particular financial uncertainty, however, interest rate improve number are usually capped to avoid serious ballooning any kind of time section. If you’d like to receive a jumbo loan having a card get less than 700, Sleeve finance could help you get the financing you want when you find yourself adhering to your own month-to-month budgetary conditions.

Have the best Jumbo Home loan Costs in California

Aside from a person’s credit score, North park Buy Money is seriously interested in bringing all of our customers the brand new most readily useful jumbo home loan costs from inside the Ca and you will nationwide. If you’re looking so you’re able to safer good jumbo mortgage managed in order to to order the home of their desires, we want to create your dream a reality.

Together, we could help you see perfect information regarding reasonable financial support to own your house, and all of the offered jumbo mortgage software you be eligible for. We strive to help you get a knowledgeable jumbo mortgage prices whenever you are sticking with our coverage out-of popular-experience underwriting. E mail us today and you may help all of us of advantages help you find the right mortgage into the proper terms and conditions…. to find the family you are going to love upcoming household so you’re able to for decades ahead!

Usually, 2 years regarding tax statements is just one of the regular jumbo financing requirements. However, oftentimes (particularly which have good credit rating) a loan provider need only one year’s worth of financial suggestions. With a lower life expectancy credit history for a beneficial jumbo mortgage apps, its virtually protected that you’ll you desire 2 yrs regarding tax returns to aid make sure your revenue.