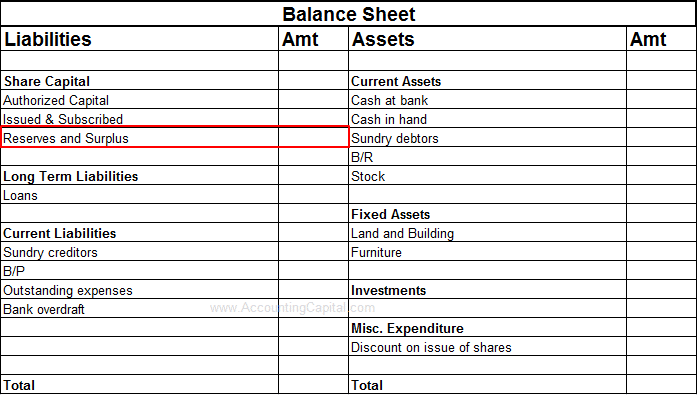

The income statement provides a narrative of a company’s profitability, and losses are a significant part of that story. For instance, operating losses arise from the company’s core business activities, while non-operating losses might include one-time costs or write-downs of assets. The distinction helps in analyzing the operational efficiency and long-term viability of the business. A P&L statement summarizes the revenues, costs, and expenses of a company during a specific period. It is one of three financial statements that public companies issue quarterly and annually—the other two are a balance sheet and a cash flow statement.

Limitations of the P&L Statement

- The reason behind this is that any changes in revenues, operating costs, research and development (R&D) spending, and net earnings over time are more meaningful than the numbers themselves.

- Additionally, shareholders might express concerns further affecting future funding.

- This metric reflects the direct costs involved in producing the goods or services sold by a company.

- Investors and analysts use financial statements to assess the financial health of a company and its growth potential.

- You will want to enter all items on income statement (also known as a profit-and-loss statement) correctly.

It’s the culmination of all business activities and decisions reflected in one number. With Gross Profit in hand and Operating Expenses listed out, the difference gives us the Operating Income. This metric gives stakeholders an insight into the money made from core operations. Operating expenses cover administrative, general, and selling expenses not directly tied to production. A business selling high but producing at exorbitant costs is a ship sailing towards a storm. The P & L Statement offers a window into the profitability of a business.

Losses and Taxes

You can find many templates to create a personal or business P&L statement online for free.

Can a company with positive revenues still have a net loss?

Insurance serves as a strategic tool for businesses to manage financial losses by transferring risk to a third party. Various types of insurance policies cater to different risks, such as property damage, liability claims, and business interruption. By paying a premium, a company can safeguard against substantial financial damage that could otherwise jeopardize its operations. It begins with an entry for revenue, known as the top line, and subtracts the costs of doing business, including the cost of goods sold, operating expenses, tax expenses, and interest expenses.

As such, this report is sometimes called a statement of financial activities or a statement of support. An example of a capital loss is when an investment listed in the books at $48,000 is sold for $45,000; this leads to a capital loss of $3,000. Staying on top of your accounts can help you track your revenue and losses easily. ABC Company, based in Florida, purchased a building many years ago at a historical cost of $250,000. It has taken a total of $100,000 in depreciation on the building and therefore has $100,000 in accumulated depreciation. The building’s carrying value, or book value, is $150,000 on the company’s balance sheet.

Profit and Loss Statement Meaning, Importance, Types, and Examples

For most optimization algorithms, it is desirable to have a loss function that is globally continuous and differentiable. In economics, decision-making under uncertainty is often modelled using the von Neumann–Morgenstern utility function of the uncertain variable of interest, such as end-of-period wealth. Since the value of this variable is uncertain, so is the value of the utility function; it is the expected value of utility that is maximized.

The overall goal of asset impairment is to periodically evaluate a company’s assets to make sure the total value of the assets is not being overstated. An impaired asset is one that has a market value less than what is listed on the company’s balance sheet. There are various factors how to make a commercial invoice that can affect an asset’s value so periodically checking its value is prudent business management. When testing an asset for impairment, the total profit, cash flow, or other benefits that can be generated by the asset is periodically compared with its current book value.

While losses are not a positive addition to a company’s finance, there is no reason that a loss should spell the demise of the business. However, repeated net operating loss over an extended period of time can result in insolvency, which may require eventual liquidation. In the realm of finance, uncertainty is a key element that both individuals and businesses must navigate. It refers to the unpredictability of market changes and specific business-related outcomes, which the lack of concrete knowledge can lead to potential financial losses. A well-planned budget is a primary line of defense against potential losses. Regular budget reviews are performed to identify areas where costs can be cut or where spending can be more efficient.

Comparing one company’s P&L statement with another in the same industry that is similar in size can further help investors evaluate the financial well-being of a company. For example, doing so might reveal that one company is more efficient at managing expenses and has better growth potential than the other. Capital losses are losses made on the sale of a fixed asset or resulting from raising money for the business. After assessing the damages, ABC Company determines the building is now only worth $100,000.

This might cause severe reputational damage and impede trust building among stakeholders, customers, and the community-at-large. Losses from the sale of an asset is reported as nonoperating items since the loss is not from the main business activity. Private companies, on the other hand, are not necessarily required to comply with GAAP. Some smaller companies, though, may not even prepare formal financial statements at all. In this case, it is considered an unrealized loss if you have not yet sold the asset, and so cannot be claimed as a tax deduction. Conversely, if you have incurred the loss by selling the asset, then you can claim a tax deduction on the amount of the loss.

The building is therefore impaired and the asset value must be written down to prevent overstatement on the balance sheet. An asset’s carrying value, also known as its book value, is the value of the asset net of accumulated depreciation that is recorded on a company’s balance sheet. The purpose of a P&L statement is to provide information about a company’s overall ability to generate profit, either by increasing revenue or decreasing costs, or both.