It’s important because it will become the cost of the inventory which will impact the selling price. Indirect materials, electricity charges and salaries of engineer and supervisor are all indirect costs and have, therefore, been added together to obtain total manufacturing overhead cost. Cost Accounting is a form of managerial accounting that helps the company in assessing the total variable cost so as to compute the cost of production. Cost accounting is generally used by the management so as to ensure better decision-making. In comparison to financial accounting, cost accounting has to follow a set standard ad can be used flexibly by the management as per their needs. The types of Cost Accounting include – Lean Accounting, Standard Costing, Marginal Costing and Activity Based Costing.

Prime cost formula

By using conversion costs, we can calculate an efficient way of determining equivalent units and unit costs. Job costing is adhesive costs of each and every job what is double-entry bookkeeping a simple guide for small businesses involved in the production processes. It is a method which determines the cost of specific jobs, which are performed according to the consumer’s specifications.

Manufacturing Cost

- Rather, such expenses are considered as indirect labor which goes to the entity’s total manufacturing overhead cost (discussed later in this article).

- The types of Cost Accounting include – Lean Accounting, Standard Costing, Marginal Costing and Activity Based Costing.

- Cost Accounting is a form of managerial accounting that helps the company in assessing the total variable cost so as to compute the cost of production.

- Without proper control, it can lead businesses into financial ruin if not managed properly by management teams who know what’s best about how much each item should retail for.

- They are the indirect cost that incurs to support the manufacturing, but it is very challenging to apply the cost to each production unit.

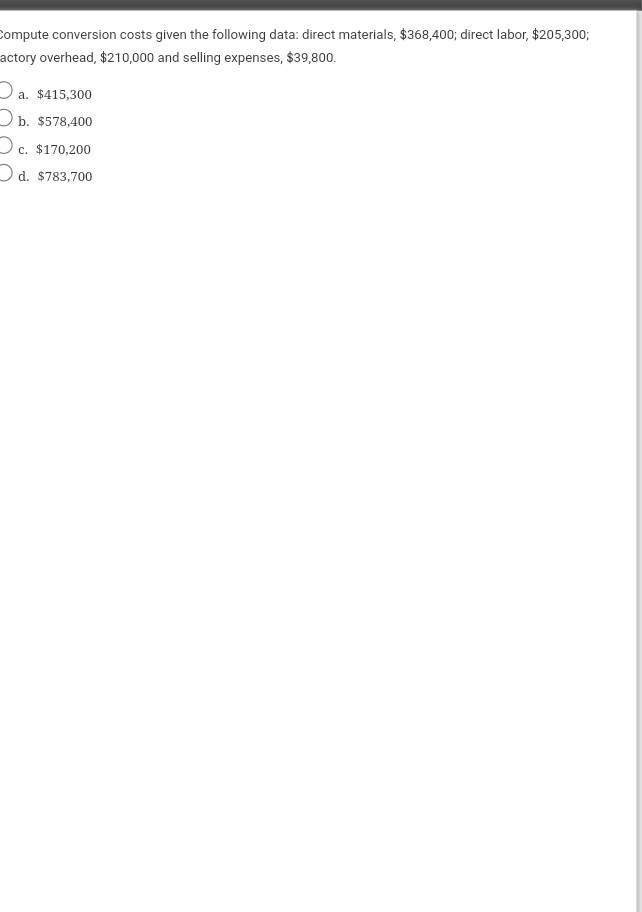

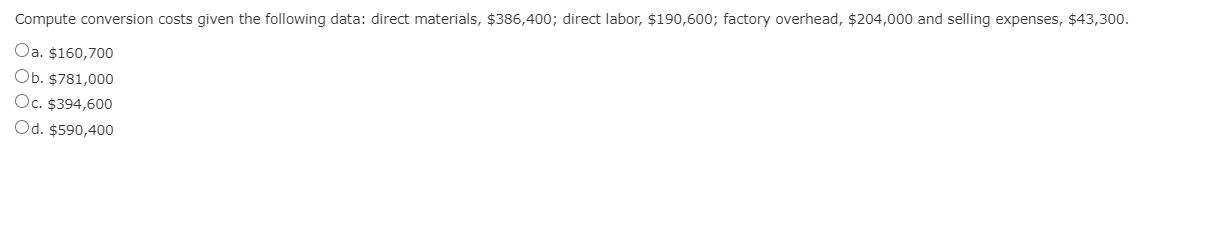

Conversion cost, as the name implies, is the total cost that a manufacturing entity incurs to transform or convert its direct materials into salable or finished product. Typically, it is equal to the sum of entity’s total direct labor cost and total manufacturing overhead cost. The expenses and remunerations attached to workers and employees who merely support the production facility and are not actively involved in converting materials into ultimate product are not included in direct labor cost. Rather, such expenses are considered as indirect labor which goes to the entity’s total manufacturing overhead cost (discussed later in this article). Examples of such expenses include the salaries of production supervisor and factory watchman etc.

Conversion cost formula

Timber, glue, nails, glass and finishing materials have been treated as direct materials because they all become part of finished and ready to sell table. The conversion cost, when used in conjunction with prime cost, helps reduce waste and gauge other operational inefficiencies that may be present within the manufacturing facility. The cost of a product is determined by the amount of labor and overhead needed to convert raw materials into finished goods. The cost of manufacturing a product cannot be traced to just one unit in the process. Some common examples are insurance, building maintenance, machine breakup, and taxes on equipment or machining. It excludes the salary of management, office staff, and other people who are not working directly with the products.

In manufacturing sector, the basic production costs can be categorized differently depending on the purpose and use of categorization. This categorization is helpful in determining the efficiency of manufacturing facilities and processes in producing their output. During June, Excite Company’s prime cost was $325,000 and conversion cost was $300,000.

Job costing is possible only in businesses where the production is done as per the customer’s requirement. A periodical review of the firm’s prime cost is crucial to ensure the efficiency of its manufacturing process. The computational responsibility lies with the factory manager who collects the relevant data, calculates the prime cost figure for the period and reports the same to operations manager for review. Direct labor is the cost that a manufacturing entity incurs for wages, salaries and benefits provided to production workers i.e., the workers who directly and physically handle the manufacturing process in a facility. Examples of direct labor workers include welders, machine operators, assemblers and painters etc.

In a typical manufacturing process, direct manufacturing costs include direct materials and direct labor. However, they may also include the cost of supplies that are directly used in production process, and any other direct expenses that don’t fall under direct materials and direct labor categories. The conversion of materials into a finished product is what we call “conversion.” It’s an important process that happens at every stage in the manufacturing cycle. The more complex and sophisticated the products become, though the higher this cost can potentially go up. The use of this ratio in process costing is to calculate the cost for both direct labor and manufacturing overheads.

Without proper control, it can lead businesses into financial ruin if not managed properly by management teams who know what’s best about how much each item should retail for.