You shouldn’t be conned by the name of one to 2nd one. You will be qualified when you find yourself to purchase property within just regarding the any outlying town and many suburbs. As a bonus, you don’t have to be engaged inside farming by any means to qualify.

You really have noticed the phrase “mawithin the” for the “a few fundamental variety of mortgage no deposit.” This is because there are more, quicker of these. Particularly, Ds bring like purchases so you can physicians and you will doctors, and many anybody else do in order to other medical researchers. Meanwhile, regional software might provide help to many other kinds of trick experts, like earliest responders or teachers.

Virtual assistant fund

Virtual assistant finance are probably the most well-known sort of zero-down-commission home loan. Once the name means, they truly are offered simply to experts and you will newest servicemembers. Whenever you are that, and you can haven’t been dishonorably released, there’s a premier possibility your be considered. Although not, there are a few Va qualification laws, mainly about the time and you can lifetime of your own services.

With your finance, you only pay a-one-date financing percentage upfront. That is currently dos.3% of mortgage worth getting very first-go out buyers and make no advance payment, although it might change in the future. Luckily for us you could add one into the mortgage rather than coming up with the cash.

Va mortgage advantages and disadvantages

But not, you’ll find restrictions about this, as well as any closing costs you want to roll up towards the financing. This is because you can’t acquire over 100% of one’s appraised market value of the home. So you could need to find an empowered seller otherwise an excellent bargain the home of manage to have sufficient space locate all of your current will cost you regarding financing. Its a misconception that people with Va finance can push a great vendor to pay for closing or any other costs.

One to funding commission was an aches. But it is including a true blessing. Whilst substitute the new monthly home loan insurance coverage extremely customers pay, if they cannot increase a 20% advance payment. Through the years, it may help you save a lot of money.

This new Va does not set any minimum thresholds to possess credit scores. However,, due to the fact revealed above, personal lenders can get — and most would.

USDA fund

You may be forgiven to own incase USDA financing was categorized Most readily useful Miracle. Not enough men and women have even observed all of them. So many that heard of all of them suppose these include just for those involved with agriculture or perhaps who would like to live in a rural backwater. However, none of these is valid.

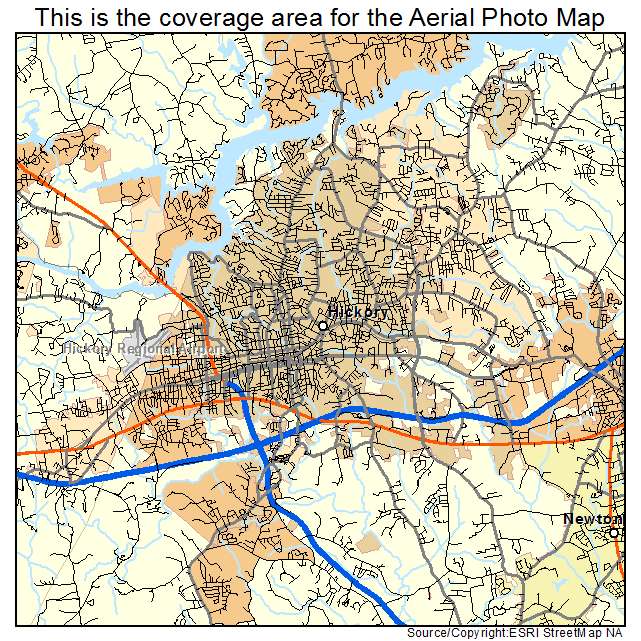

Indeed, many imagine one 97% of one’s landmass of your You drops from inside the territory qualified to receive an excellent USDA financing. The latest USDA webpages has a search product that allows you to browse getting personal tackles one be considered. And it also is sold with lots of suburbs. At the same time, there’s absolutely no criteria understand one to end regarding an effective tractor — if not out of an excellent hoe — in the most other.

USDA finance: Eligibility and you can standards

You’ll find, although not, certain individual eligibility obstacles that may journey right up of a lot. This type of finance are designed for reasonable- and you can low-income household and https://paydayloanflorida.net/lake-hamilton/ people. Therefore cannot earn much more than 115% of one’s median money in your area. How much cash is that? Once more, brand new USDA website lets you consider income constraints condition because of the condition. The greater amount of members of your household, more you can make nevertheless qualify.

When you get one among these, you will have to pay a fee of just one% of amount borrowed in your closing costs. It fee is going to be put in the mortgage equilibrium, providing you cannot use in total over 100% of one’s house’s appraised market price.