Because there are all types of multifamily capital, credit score criteria are different

- Credit score: Lenders are certain to get different credit rating standards according to mortgage sort of needed. That said, certain need results only 500, whereas anybody else will get consult a get out-of 680 or more. The greater the rating, the greater the possibilities of recognition. In case your rating is leaner, you can even find lenders one specifically matter fund getting bad credit.

- Time in team: Particular funds possess amount of time in organization standards to demonstrate the financial support experience. This really is popular having enhance-and-flip financial investments, given that financial wants to mitigate the possibility of default on the borrowed funds and can even perhaps not give so you can beginner buyers.

- DSCR: DSCR try determined as your online working earnings split by the newest year’s debt. It is one good way to measure your own businesses ability to shell out the costs according to your hard earned money disperse.

- Down-payment: Down-payment criteria can vary off 0% to as much as twenty five% or maybe more. Whilst not necessary for all multifamily fund, it is possible to generally find a very good costs and you may financing words out-of company which need a much bigger down payment.

Since there are various types of multifamily financing, credit score requirements differ

- Banks: Financial institutions normally have an array of financing products. However, certification standards include rigorous with little to no independency for policy exceptions. Along with financial loans, you can observe the variety of an informed financial institutions for real property buyers for further services such expense administration solutions and you can rent collection.

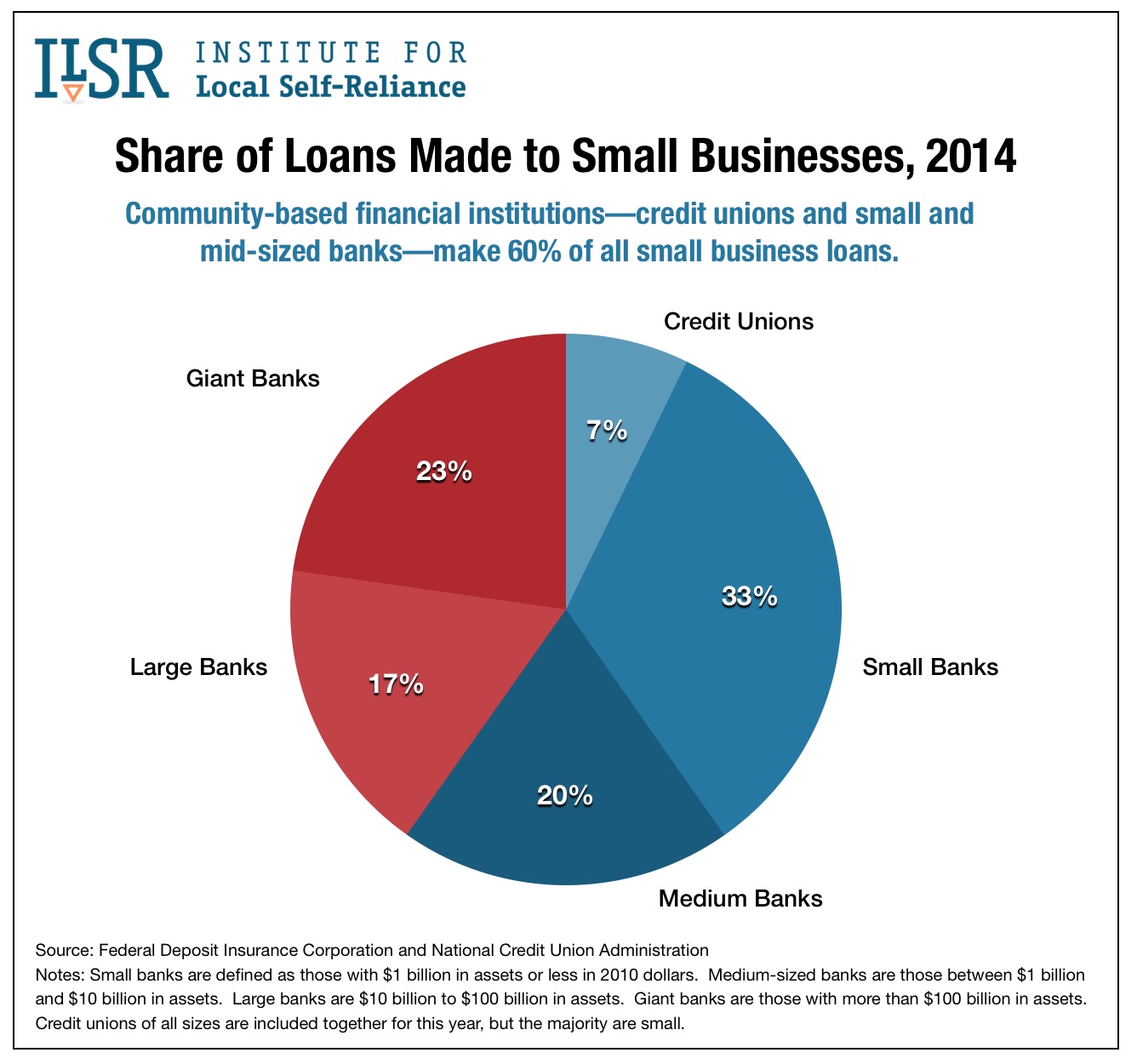

- Borrowing from the bank unions: Credit unions are not-for-funds teams to provide alot more aggressive rates than banks. According to the borrowing from the bank partnership, you can also have more self-reliance pertaining to eligibility conditions. One downside, no matter if, would be the fact these lender may not have as much affairs just like the compared to a lender. Our roundup of your better credit unions for smaller businesses get getting an effective starting point.

- On line lenders: Such supplier could offer several of the most competitive costs. This is certainly partially whilst has fewer costs having things like rent payments to possess bodily branch towns and cities. In exchange for straight down rates, you need to be comfortable doing business primarily on line. Here are a few all of our listing of an educated commercial real estate funds for almost all choices.

- Mortgage brokers: Brokers provides a network off lending people and will use its possibilities to suit you towards financing most appropriate to suit your means. Any of the team within guide to a leading team mortgage brokers can save you time out-of implementing on their own to numerous loan providers.

Once you have discovered a relevant financial, confirm the qualifications and fill out a formal loan application. You’ll want to complement the application form with assorted documentation, as the asked by lender.

The exact a number of needed documents vary based on the loan, the lender you select, and your particular circumstancesmonly questioned factors is tax returns, bank statements, and other monetary comments-eg an equilibrium sheet and money & loss statement.

Abreast of review of your application, the financial institution usually show your own qualifications. In the event the recognized, it does provide you with mortgage information inclusive of cost and you can conditions.

Frequently asked questions (FAQs)

Lenders will receive other determining factors when issuing a lending choice; although not, you really need to opt for a score of at least 600 so you can be considered eligible for really types of financing.

It all depends to the version of loan Wray loans you get. Usually, you’ll find owner-occupancy criteria very important to authorities-recognized fund. Because the a condition of the financial support, you need to alive and you may conduct business from the possessions become entitled to funding solutions.