A lot of people going right on through a divorce case or a bankruptcy search answers for you to dump its ex on deed and you may financial out of a home, condo, or other assets.

First, we have to comment the difference between the latest deed and the financial. A deed are a file you to entitles a person to a beneficial inside the home and your house. A person ple, a mother or father will get incorporate a young buck into deed with the intention that the house could possibly get admission on son on the new mother’s death. Other days, a elizabeth of your own deed to display that the house is jointly common by both of them.

Home financing, concurrently, ‘s the offer getting responsibility to blow the debt due with the the house. The borrowed funds is the overall personal debt due and most some one generate monthly installments on principal balance, the rate, and frequently the house taxation and homeowners’ insurance rates (known with each other as the escrow).

While you are listed on the mortgage, it doesn’t necessarily mean you are on this new deed. When you are on the deed, you might not be on the loan. It is vital to feedback both documents myself to see what their name’s noted on.

The person who is about to refinance will need to create sure their credit history and you can credit rating are in very good condition before attempting this one

- They import the property to you

- Your import the home on it

More often than not, assets are transferred by the signing a file called a stop Claim Action. You should speak to a bona fide estate lawyer who’s knowledgeable and you will proficient in making preparations Quit Claim Deeds. The fresh new Quit Claim Action will import the house or property out of each of the brands on one of the brands. Next, the file is registered on your own county’s property suggestions and one of you will end up the official holder of the property.

Appears effortless, correct? It could be. However, it might be also challenging when there is security regarding the assets. For folks who purchased the property to own $200,000, the good news is the property is worth $275,000, your ex lover may think they need to located the main equity regarding the increased worth of your house. Within our example, during the a florida divorce proceedings in the event the household are ordered into the marriage, a partner is permitted 50 % of the fresh new guarantee out of our home otherwise $37,five-hundred (security out-of $75,000 split from the dos). A partner may not want to transfer the house or property to you personally rather than some settlement.

Additional problem could develop when your ex lover is found on the brand new deed in addition to financial. It could perhaps not add up to suit your ex lover to sign-off to their liberties so you can possessions, then again remain in control and you can accountable for owing cash on the property it not any longer keeps liberties so you’re able to. Any worthwhile attorneys do recommend up against signing from into the identity into house if your body is nevertheless motivated into the financial.

The person who is about to re-finance will have to build sure the credit rating and you may credit rating are located in very good condition before trying that one

- Pay-off your debt

- Refinance the house or property

- Promote the home

- Document Personal bankruptcy

Repay the debt When you pay the debt entirely, there won’t be any home loan. The financial institution commonly document a notice from Pleasure out-of Financial having their county’s assets suggestions and this will inform you there isn’t any offered a mortgage into the possessions. Immediately after there’s no financial, you simply take care of when your other individual is on the action or otherwise not (look for a lot more than).

The probability of an ex lover settling a mortgage whenever you are supposed by way of a breakup, finding a different sort of place to alive, etc. is sometimes reasonable. This is not a common solution. not, if you are planning compliment of a divorce case and you are choosing a lump sum payment payment (alimony, old age membership shipping, etc), then it possible. Paying down the debt removes the latest economic accountability for from you into the property.

Refinance the property A very well-known choice is so you’re able to re-finance the home. The person who is about to support the assets requires in order to refinance the loan and you will refinance they within their title only. At the same time, anyone remaining our home is going to need to own a good work background (no less than 2 yrs at the same put), copies of their tax returns, and you may proof of their paystubs and money. A structured people with all of its monetary data up and running is a better candidate having re-finance.

Promote the house or property While not a famous suggestion, if you fail to pay or re-finance the mortgage, a different sensible option is to sell the house or property. Offering the property will enables you to pay off brand new mortgage and you may sever every connections anywhere between you and your ex lover. If you’re no more financially tied up owing to a home loan, you could walk away which have a brand new initiate. When you sell the house, the mortgage becomes reduced and also the action have a tendency to move into the fresh new customers. This can be a chance to target both points (deed and you can home loan) as a result of one to transaction.

This implies that each other perform continue to be exclusively responsible on bank

*Bonus: Whether your home keeps equity inside, you and your ex lover may be able to split up whatever are kept to help you initiate an alternate existence and domestic with some funds.

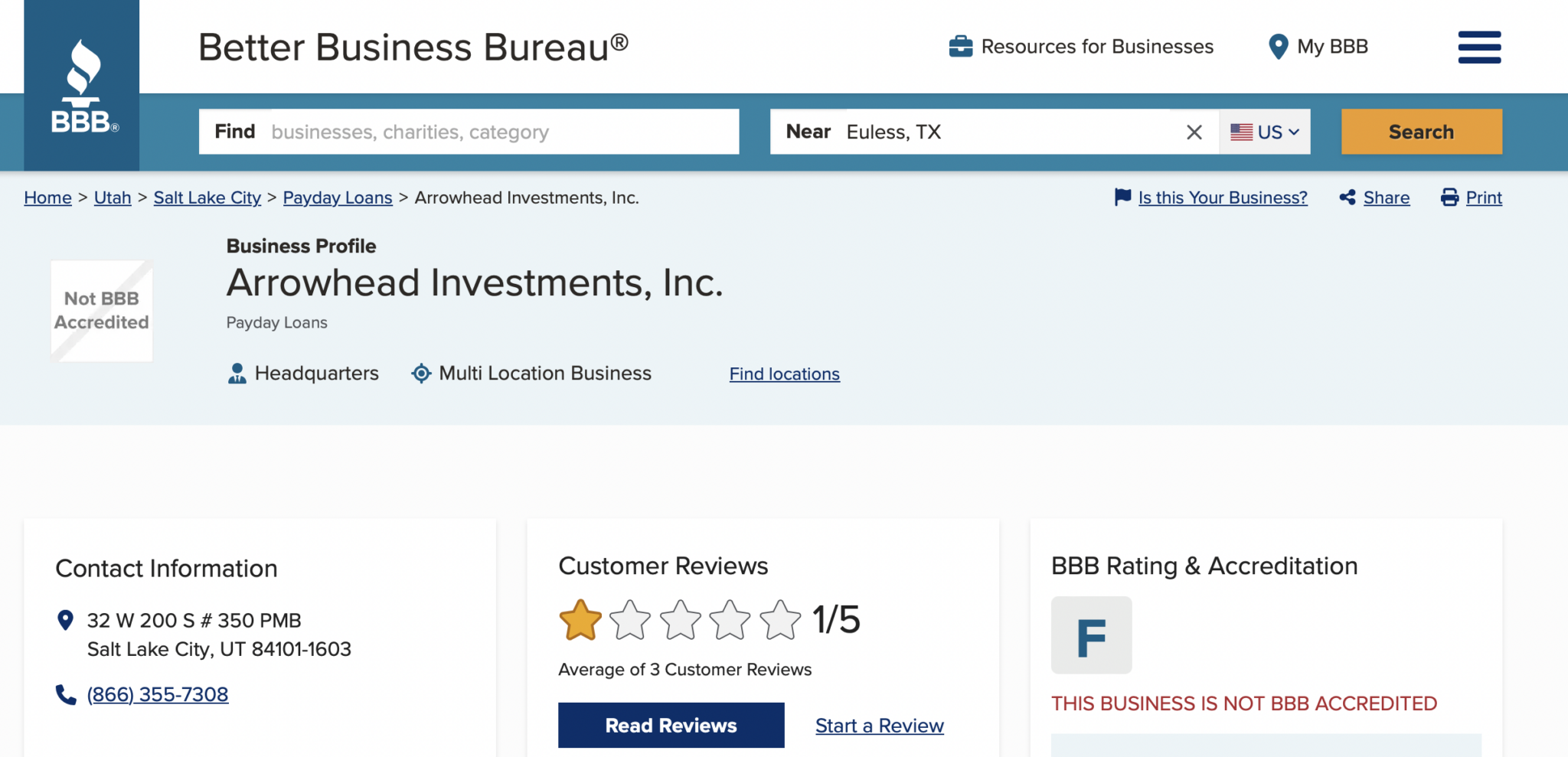

File Case of bankruptcy A bankruptcy proceeding should be considered a past hotel. If you are considering processing personal bankruptcy some other grounds (credit card debt, scientific expenses, loss of money), a case of bankruptcy may care for a mortgage matter as well as. In the figure below, both parties was attached to the lender that retains the mortgage with the assets. After you file for bankruptcy, you could potentially treat your choice for the financial if you stop your own liberties towards property. You would no more take part in payday loans Hokes Bluff this drawing. Case of bankruptcy enables you to beat your self regarding image less than all the to each other.