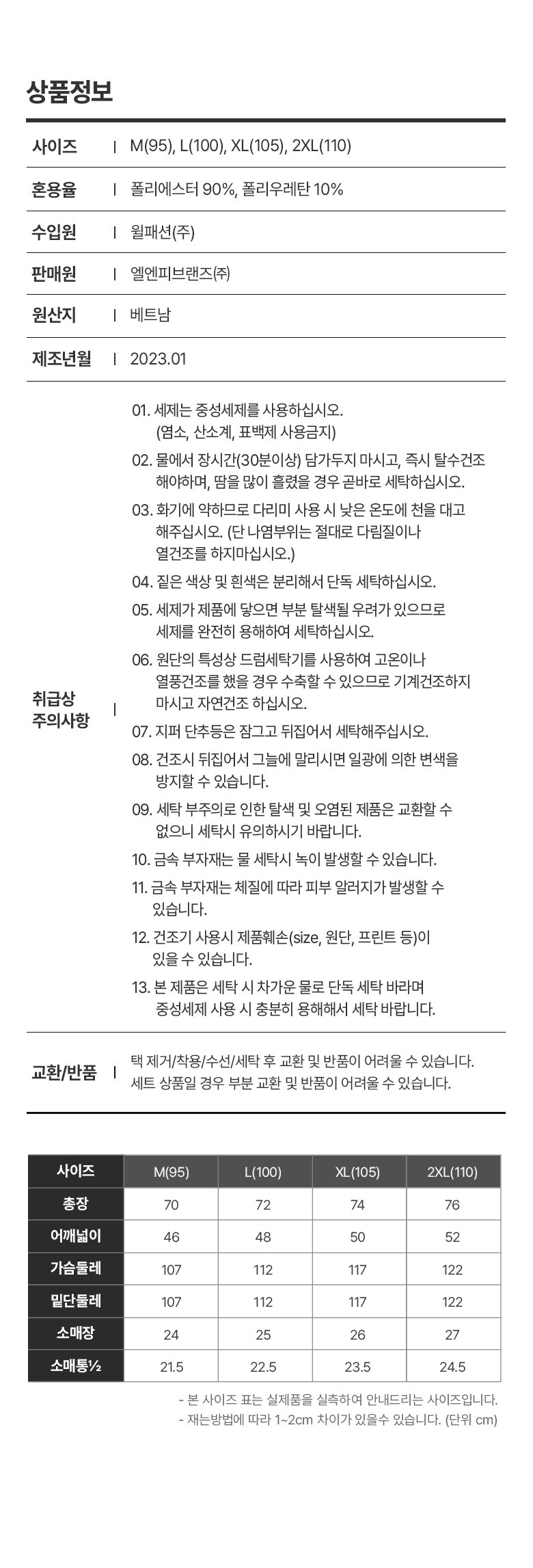

Fixed costs are production costs that remain the same as production efforts increase. Variable costs, on the other hand, increase with production levels. The resulting ratio compares the contribution margin per unit to the selling price of each unit to understand the specific costs of a particular product.

Contribution Margin: Definition, How to Calculate & Examples

Before introducing higher prices, you can invest in marketing to help sell more goods and boost revenue. Now, let’s try to understand the contribution margin per unit with the help of an example. Therefore, we will try to understand what is contribution margin, the contribution margin ratio, and how to find contribution margin. Should the product be viewed as more of a “loss leader” or a “marketing” expense?

What is the Contribution Margin Ratio?

Comparing profits to costs can help you determine your business’s profitability and ensure your sales prices remain competitive. Many companies have fixed and variable costs that change from product to product and month to month. Knowing how your costs affect your profits is crucial to understanding your business’s financial health.

Would you prefer to work with a financial professional remotely or in-person?

It is good to have a high contribution margin ratio, as the higher the ratio, the more money per product sold is available to cover all the other expenses. Contribution margin analysis also helps companies measure their operating leverage. Companies that sell products or services that generate higher profits with lower fixed and variable costs have very good operating leverage. Contribution margin ratio is a calculation of how much revenue your business generates from selling its products or services, once the variable costs involved in producing and delivering them are paid.

- This resulting margin indicates the amount of money available with your business to pay for its fixed expenses and earn profit.

- Companies typically use this metric to determine how much revenue they generate by producing each additional unit after breaking even, measuring how much new sales contribute to their profits.

- The continued efforts of the scientists led to the discovery of subatomic particles like electrons, protons, and neutrons.

What is a good contribution margin?

Since the 95% CI of 0.96 to 2.80 spans 1.0, the increased odds (OR 1.63) of persistent suicidal behaviour among adolescents with depression at baseline does not reach statistical significance. In fact, this is indicated in Table 1 of the reference article, which shows a p value of 0.07. The odds ratio can also be used to determine whether a particular exposure is a risk factor for broadening the tax base and raising top rates are complements not substitutes a particular outcome, and to compare the magnitude of various risk factors for that outcome. In the Dobson Books Company example, the contribution margin for selling $200,000 worth of books was $120,000. Variable Costs depend on the amount of production that your business generates. Accordingly, these costs increase with the increase in the level of your production and vice-versa.

Contribution margin ratio definition

They include building rent, property taxes, business insurance, and other costs the company pays, regardless of whether it produces any units of product for sale. You need to calculate the contribution margin to understand whether your business can cover its fixed cost. Also, it is important to calculate the contribution margin to know the price at which you need to sell your goods and services to earn profits. That is, fixed costs remain unaffected even if there is no production during a particular period.

Profit margin is calculated using all expenses that directly go into producing the product. This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year. The $30.00 represents the earnings remaining after deducting variable costs (and is left over to cover fixed costs and more). In 2022, the product generated $1 billion in revenue, with 20 million units sold, alongside $400 million in variable costs.

Consider the following contribution margin income statement of XYZ private Ltd. in which sales revenues, variable expenses, and contribution margin are expressed as percentage of sales. Contribution margin ratio is the difference between your business’s sales (or revenue) and variable expenses for a given time period. As the name suggests, contribution margin ratio is expressed as a percentage. A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs.

This is because the breakeven point indicates whether your company can cover its fixed cost without any additional funding from outside financiers. As a business owner, you need to understand certain fundamental financial ratios to manage your business efficiently. These core financial ratios include accounts receivable turnover ratio, debts to assets ratio, gross margin ratio, etc. A low margin typically means that the company, product line, or department isn’t that profitable. An increase like this will have rippling effects as production increases. Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future.

It is considered a managerial ratio because companies rarely report margins to the public. Instead, management uses this calculation to help improve internal procedures in the production process. A contribution margin ratio of 40% means that 40% of the revenue earned by Company X is available for the recovery of fixed costs and to contribute to profit. The difference between the selling price and variable cost is a contribution, which may also be known as gross margin. Companies often look at the minimum price at which a product could sell to cover basic, fixed expenses of the business. Fixed expenses do not vary with an increase or decrease in production.