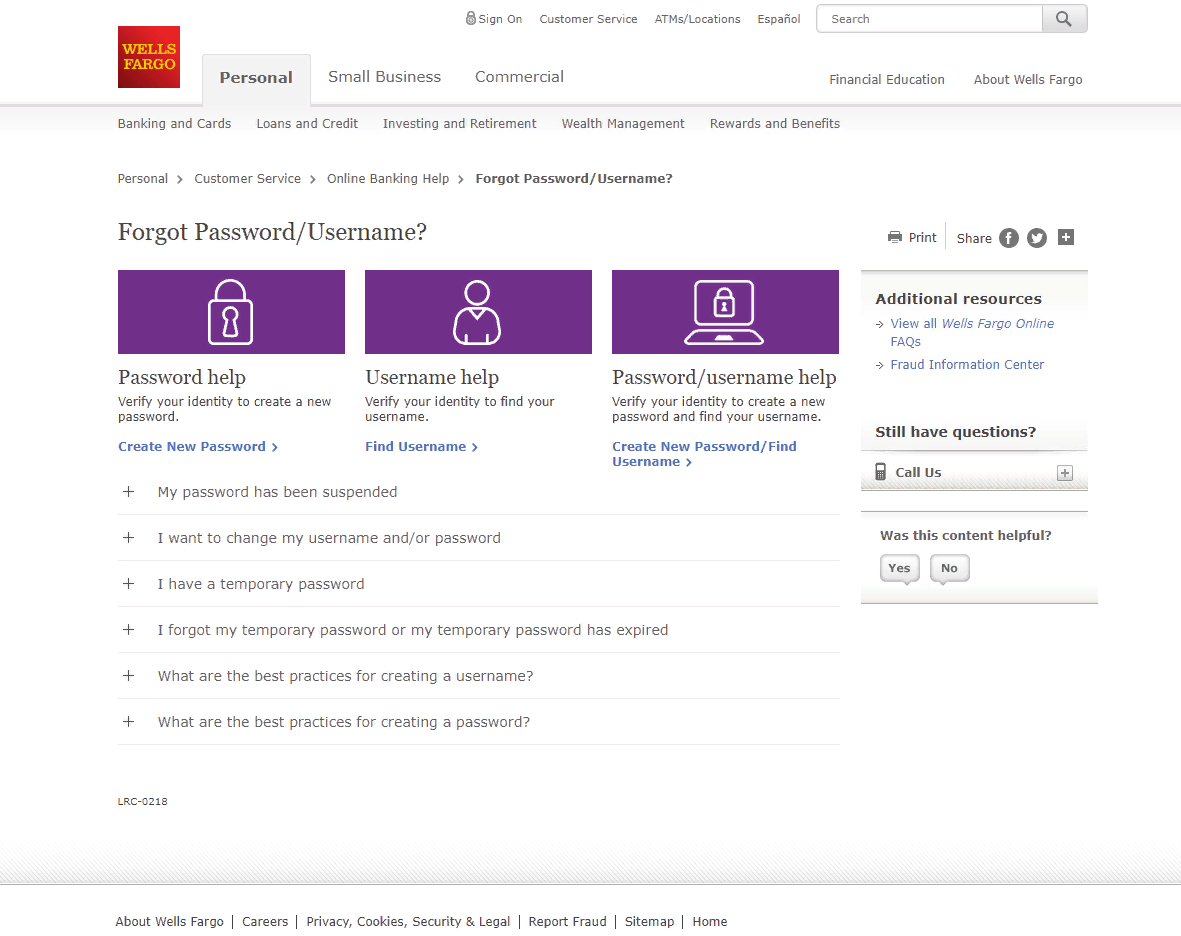

Examiners have a tendency to choose violations during the adverts on monetary institutions’ websites. This will effects when a third-class seller are chose to create the site as well as the seller try unacquainted with the fresh new advertising laws and regulations. This case depicts why it’s important to are websites inside the advertising product reviews:

A lender current the website and you may incorporated the present day attract rate to possess a buyers finalized-prevent unit but didn’t disclose new Apr. Likewise, brand new web page integrated a payment chronilogical age of as much as 2 years (that’s an inducing name around Controls Z) but don’t are the needed additional disclosures. These types of violations lead regarding supervision situations, as the standard bank hadn’t designed to divulge rates or become causing terminology into the site of these affairs. Then, the newest exterior auditor recognized an equivalent causing identity matter to the webpage out of an advertising to have a special loan product. When you are step was taken to correct brand new web page the latest auditor flagged, management did not remark this new page ads to other mortgage unit to verify these were conforming for the advertising conditions.

This new voice practices loan providers can use to deal with advertisements threats are similar to the practices having a great conformity management system. In occasions, these types of strategies are tailored towards the proportions and difficulty out-of the college. Listed here are types of sound strategies loan who makes personal loans in Jacksonville area providers can use in order to adhere to Controls Z’s advertising requirements.

Energetic Oversight from the Panel and you will Elder Administration

The fresh board out of administrators and you may senior government try in the course of time guilty of supervising the fresh monetary institution’s conformity administration program; making it extremely important it obviously see the conformity dangers in order to the college and you can expose compatible regulation to decrease the individuals risks. As a result, the fresh panel and you may older administration may wish to see the individuals advertisements tips the institution spends to make certain appropriate allocation from conformity info.

To have loan providers which use third parties to create advertisements posts, oversight is key. Earliest, the new panel and you may senior government will get believe delivering procedures so you can appropriately pick and you may manage the 3rd party. 45 Second, elder administration need to make sure techniques and functions try in position toward conformity department to review 3rd-people advertisements. That it review will act as a secure having guaranteeing the advertisements meet with the monetary institution’s standards and you may adhere to Regulation Z.

Principles, Measures, and Products

Loan providers having solid compliance government assistance features policies, strategies, and you may products positioned to ensure the place was conforming with the new advertising standards from Regulation Z. Examples include: (1) undertaking worksheets or checklists to possess employees which carry out advertising to aid all of them comprehend the adverts requirements, (2) making certain the fresh conformity agencies completes a holiday feedback (that have a record), and you can approves people adverts prior to use, and you may (3) making sure the brand new compliance service ratings and you will confirms any changes made to this site making sure that every changes have been made since implied and there are no accidental conformity effects.

If you are faster creditors will get rely on knowledgeable and you may long-tenured personnel to be certain conformity to your advertising requirements, good regulations, strategies, and units are extremely advantageous to handle personnel turple, employees turnover was the primary cause regarding Regulation Z violations. Reported by users, truly the only constant in daily life is change; creditors which have solid conformity possibilities proactively plan eventual employees turnover in place of answering to transform when they accidentally end dropping crucial organization studies. 46

Degree

As Frame of mind chatted about inside a previous blog post, studies software are one of the essential investment an economic organization renders with its teams. 47 Advantages to your standard bank is mitigating compliance exposure, producing a proactive conformity society, assisting effective alter management, and you will raising the consumer experience. Providing periodic degree to help you employees who happen to be accountable for Control Z adverts requirements helps the bank mitigate its compliance exposure because of the making certain that team see the nuances of your own regulations.