Consumers in the The Zealand also can consider fixed price or changeable speed mortgages as possibilities to appeal just financing. Fixed rates mortgages offer confidence and balances in costs, when you’re adjustable rates mortgages also provide self-reliance and possible discount in the event the interest levels drop off. It is necessary to own borrowers to closely evaluate various other mortgage options and you may imagine its individual monetary facts before carefully deciding.

Frequently Remark The money you owe

You to very important idea will be to regularly feedback your financial situation and long-identity specifications, such as for example as the avoid of one’s focus-merely months tips. Home owners should think about whether or not they are able to afford large repayments since the financing converts so you’re able to a fees financial, of course perhaps not, they might have to talk about refinancing solutions or build additional payments for the investment when you look at the desire-just several months.

Monitor Alterations in Interest rates and you will Property Markets Criteria

A separate tip will be to carefully display screen alterations in interest levels and you can possessions business conditions. Homeowners which have interest-simply mortgages tends to be more vulnerable to activity in the rates of interest, that may effect their ability to meet up with the financing costs. It’s important to possess home owners to keep told in the alterations in desire costs and you may believe exactly how such alter can affect its mortgage.

Find Elite group Economic Information

Homeowners must think seeking to elite economic pointers away from a mortgage broker otherwise economic mentor who can bring designed advice based on the individual circumstances. A specialist mentor can help residents know its selection to make advised conclusion regarding the handling their interest-only home loan.

The future of Appeal Just Home loans when you look at the The new Zealand

The future of attract simply mortgage brokers in The fresh new Zealand is actually probably be dependent on enough products, including regulating alter, business fashion, and you will economic conditions. Recently, there have been improved scrutiny to your desire just finance out of government and you can financial institutions, that have a watch making certain responsible financing means and you will mitigating payday loan New Site dangers of these types of mortgage loans. Down seriously to this type of improvements, you are able that lenders will get still tense their lending standards getting interest just lenders inside Brand new Zealand.

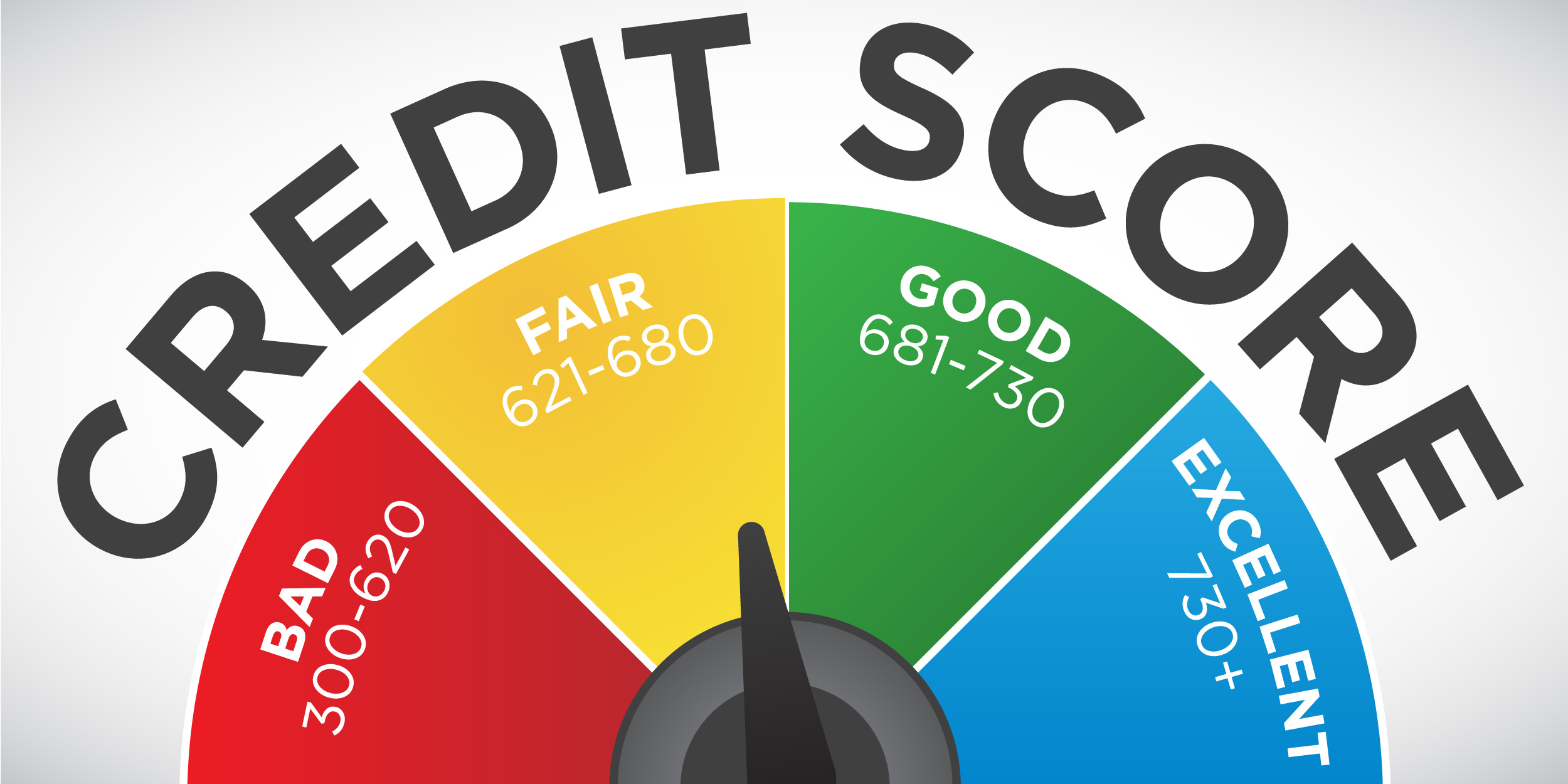

This could enable it to be harder to possess individuals in order to be eligible for such financial, particularly when he’s less than perfect credit record otherwise minimal economic balance. Concurrently, changes in fiscal conditions and you will property sector trends may impression the ongoing future of desire simply home loans inside the The latest Zealand. Movement into the possessions costs and you may leasing productivity you may dictate buyer demand of these type of mortgages, if you find yourself changes in rates make a difference borrowers’ capacity to see the financing repayments.

Total, it is necessary to have consumers in This new Zealand to carefully imagine its choice and you may look for qualified advice about an appeal simply house loan. By the getting informed on the market trends and you will regulatory transform, consumers makes advised choices regarding managing its financial effortlessly and you may minimising dangers associated with the appeal only fund.

If you are considering taking right out an appeal-only financial for the The fresh Zealand, it is critical to weigh advantages and downsides. An associated summary of titled And make Feeling of the fresh Bright-Range Test: Very important Facts to have NZ Property People will bring beneficial advice for those trying purchase property inside New Zealand. Understanding the rules and you may fees related assets financing makes it possible to make advised behavior about your financial alternatives. Have a look at post to have important information towards the The brand new Zealand assets business. Source:

What is an appeal-merely home loan?

An interest-merely financial is a kind of financial where in actuality the borrower merely pays the attention towards the loan to possess a flat months, generally 5-10 years, prior to starting to repay the primary.