(CLEVELAND) Now, KeyBank established which possess funded over $one million from inside the KeyBank House Customer Credit SM while the program’s launch inside of homeownership during the places that the application is present.

It milestone will come just under 12 months adopting the release of the applying and you may 8 months immediately following KeyBank enhanced which Special-purpose Credit System step one because of the $dos,five-hundred to add $5,000, to your settlement costs and other pre-reduced charge that will include resource a different sort of home, in order to homeowners toward purchase of qualified features.

A house is one of the most important purchases a guy otherwise family relations helps make. On Secret, we think one healthy communities are the ones in which the residents possess usage of homeownership, said Dale Baker, president away from Home Credit within KeyBank. I aim to help our very own groups prosper by not merely bringing good sense in order to sensible lending products, software, and qualities, in addition to delivering academic assistance and you will direct financing.

Recently payday loans Castleberry, KeyBank’s Fair Casing Month Poll discovered that almost you to-3rd (31%) from respondents said it don’t try to find one suggestions or resources to the house client direction software, which can help beat barriers in order to homeownership. Along with the Domestic Visitors Borrowing, the following applications are offered for being qualified services inside the eligible groups:

KeyBank worked so you’re able to link one to pit using their Special purpose Borrowing Apps, a continued commitment to permitting all-potential homebuyers make dream away from owning a home a real possibility

The key Solutions Domestic Guarantee Loan brings reasonable terms getting borrowers that have being qualified features so you can re-finance its top household in order to a lower life expectancy rate of interest, consolidate financial obligation, money renovations, otherwise make use of

their collateral when needed. This loan has actually a fixed price, with no origination commission, and you will an initial or next lien selection for money up to $100,000. As the system began into the , KeyBank funded $cuatro.seven million in money, enabling ninety five members safe funds for their no. 1 home within the appointed groups.

The KeyBank Neighbors Very first Credit is made to help homebuyers in the licensed parts across the Key’s impact along with Florida by providing right up so you can $5,000 into the borrowing from the bank for use having settlement costs and also to pre-paid costs that can feature capital another family, in addition to financial, flood and hazard insurance coverage, escrow put, real estate fees and you can each diem attention. Out of , KeyBank financed whenever $60,000 into the Neighbors First loans, helping several members reach their imagine homeownership regarding the being qualified areas where the applying can be acquired. Plus, since , KeyBank features $10.8 billion from inside the home loan apps for about $345,000 in the Locals Very first Loans to assist 71 customers (inclusive of the funded credit mutual significantly more than) on the road to homeownership during these locations.

With the Residents Basic Borrowing from the bank and you can KeyBank House Visitors Credit in position, Key keeps get credit obtainable in over nine,500 census tracts, coating places where ten% of one’s You.S society lives. KeyBank together with invested in expenses over $25 mil for the grants, commission waivers, and profit over five years to boost mortgage financing inside bulk-fraction neighborhoods, plus over $1 million so you can homebuyer training or other community assistance.

Find out about KeyBank’s household lending solutions and you may apps, determine whether property qualifies getting Special-purpose Borrowing from the bank Applications, otherwise get yourself started the journey to help you homeownership by going to trick/communitylending.

step 1 Special-purpose Credit Apps is, basically, apps which can be dependent in order to meet unique public need or even the need out-of financially disadvantaged persons by extending credit so you can people who could possibly become rejected credit or carry out discovered they toward smaller good words, less than particular criteria. Find fifteen You.S.C. 1691(c)(1)-(3); several C.F.Roentgen. 1002.8(a).

KeyCorp’s roots shadow back almost 200 ages to help you Albany, Ny. Based inside the Cleveland, Kansas, Key is among the nation’s prominent lender-oriented economic functions companies, with property of around $195 mil from the .

Secret provides put, credit, dollars administration, and you may financing characteristics to people and you will enterprises in fifteen claims under the name KeyBank National Connection through a system of around step one,000 branches and you may around step 1,300 ATMs.

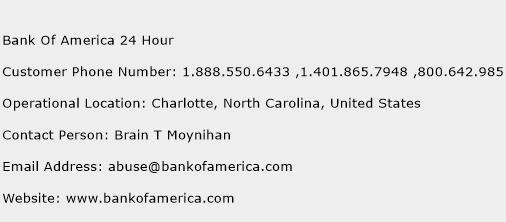

To own home elevators the current condition from regional avenues in order to respond to any queries you have, and if or not property qualifies getting Key’s Special-purpose Borrowing Software, KeyBank Mortgage loan Officials are around for let

Secret now offers an over-all list of expert business and you will funding banking items, eg merger and buy guidance, societal and personal financial obligation and you can equity, syndications and you may types to help you center market enterprises when you look at the chose industries while in the the usa underneath the KeyBanc Money

e. For more information, head to KeyBank is Member FDIC. Equal Construction Bank. Home loan and you will Home Equity Financial loans offered by KeyBank are not FDIC covered or secured. NMLS #399797